Remote Mortgage Loan Processor Jobs: Exploring Opportunities in the Digital Era

In the age of digital transformation, the concept of remote work has gained significant momentum. This shift has extended to various industries, including the mortgage sector. Remote mortgage loan processor jobs offer professionals the flexibility to work from anywhere while playing a crucial role in facilitating the home financing process. This article by Simleite explores the opportunities and benefits of remote mortgage loan processor jobs in the digital era.

Remote Mortgage Loan Processor Jobs: Exploring Opportunities in the Digital Era

Remote mortgage loan processor jobs offer professionals the opportunity to combine their expertise in mortgage loan processing with the benefits and flexibility of remote work. As technology continues to advance and the mortgage industry embraces digital transformation, the demand for remote mortgage loan processors is likely to increase. By leveraging the advantages of remote work, utilizing digital tools, and honing essential skills, individuals can thrive in this evolving field, contributing to the home financing process while enjoying the freedom and opportunities provided by remote work in the digital era.

- The Rise of Remote Work:

a. Changing Work Dynamics: The advent of advanced communication technologies and cloud-based platforms has revolutionized the way work is conducted. Remote work has become increasingly popular, allowing professionals to perform their duties from the comfort of their own homes or any location with an internet connection.

b. Advantages of Remote Work: Remote work offers numerous benefits, such as increased flexibility, improved work-life balance, reduced commuting time, and the ability to create a personalized and productive work environment.

- The Role of a Mortgage Loan Processor:

a. Understanding Mortgage Loan Processing: Mortgage loan processors play a vital role in the mortgage lending process. They are responsible for reviewing and verifying loan applications, gathering necessary documentation, assessing creditworthiness, coordinating with underwriters and other parties involved, and ensuring compliance with regulations.

b. Importance of Efficiency and Accuracy: Mortgage loan processors must work diligently to ensure smooth and efficient loan processing, as any delays or errors can impact the borrower’s experience and the overall timeline of the loan closing.

- Remote Mortgage Loan Processor Jobs:

a. Embracing Remote Work in Mortgage Processing: The mortgage industry has recognized the potential of remote work, leading to the emergence of remote mortgage loan processor jobs. These positions enable professionals to perform their duties remotely while collaborating with colleagues, clients, and other stakeholders through digital platforms and tools.

b. Advantages of Remote Mortgage Loan Processor Jobs:

i. Flexibility: Remote mortgage loan processors have the freedom to choose their work environment, whether it’s a home office, a co-working space, or even while traveling. This flexibility allows for a better work-life integration and the ability to adapt to personal needs and preferences.

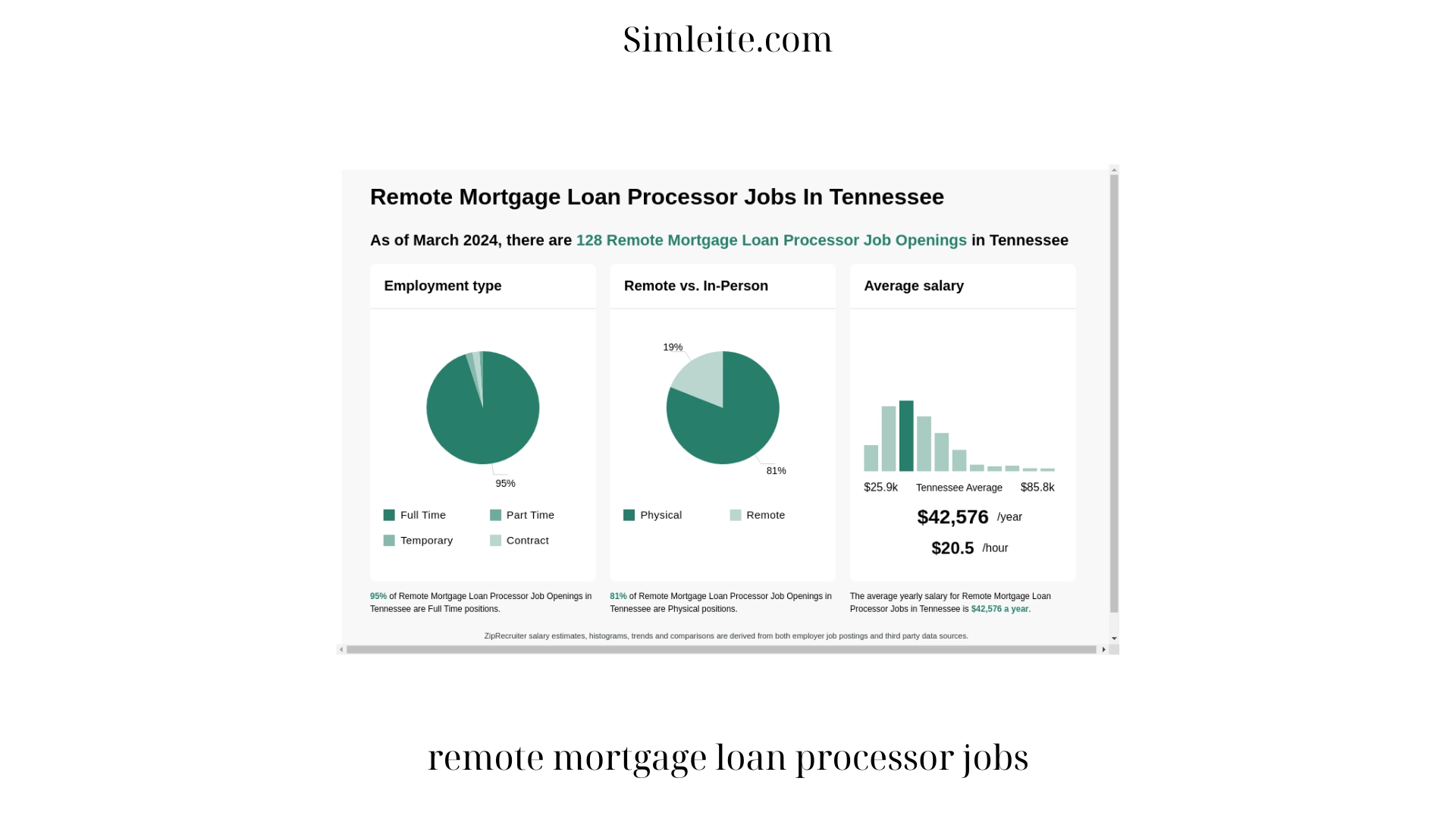

ii. Expanded Job Opportunities: Remote work eliminates geographical limitations, allowing mortgage loan processors to access job opportunities beyond their local area. This opens up a broader pool of potential employers and increases the chances of finding the right position.

iii. Cost Savings: Working remotely eliminates expenses associated with commuting, professional attire, and dining out. Additionally, remote work may offer tax advantages, such as the ability to deduct home office expenses, potentially resulting in cost savings for remote mortgage loan processors.

iv. Increased Productivity: Remote work can enhance remote mortgage loan processor jobs productivity and focus, as individuals can create a personalized workspace tailored to their needs. Distractions commonly found in traditional office settings can be minimized, leading to improved efficiency and quality of work.

- Technology and Tools for Remote Mortgage Loan Processing:

a. Digital Collaboration Platforms: Remote mortgage loan processors rely on digital collaboration tools to communicate and collaborate with team members, underwriters, loan officers, and borrowers. These platforms facilitate document sharing, real-time communication, and task management.

b. Document Management Systems: Cloud-based document management systems enable remote mortgage loan processors to securely store, organize, and access loan-related documents. These systems streamline the document review process and ensure data security and compliance.

c. Online Loan Origination Systems: remote mortgage loan processor jobs utilize online loan origination systems that provide a centralized platform for managing loan applications, tracking progress, and generating necessary reports.

- Building a Successful Remote Mortgage Loan Processor Career:

a. Skills and Qualifications: To excel as a remote mortgage loan processor jobs, individuals should possess strong attention to detail, excellent organizational skills, effective communication abilities, and a comprehensive understanding of mortgage lending regulations and procedures.

b. Networking and Professional Development: Building a network of industry professionals, attending virtual conferences or webinars, and pursuing relevant certifications can enhance career prospects and demonstrate a commitment to professional growth.

c. Time Management and Self-Discipline: remote mortgage loan processor jobs requires self-motivation, discipline, and effective time management skills. Establishing a structured routine, setting clear work boundaries, and minimizing distractions are essential for success as a remote mortgage loan processor.

Conclusion:

Remote mortgage loan processor jobs offer professionals the opportunity to combine their expertise in mortgage loan processing with the benefits and flexibility of remote work. As technology continues to advance and the mortgage industry embraces digital transformation, the demand for remote mortgage loan processors is likely to increase. By leveraging the advantages of remote work, utilizing digital tools, and honing essential skills, individuals can thrive in this evolving field, contributing to the home financing process while enjoying the freedom and opportunities provided by remote work in the digital era.