What is the Payoff Amount on a Mortgage: Understanding and Importance

When it comes to mortgages, understanding the payoff amount is crucial for borrowers. Whether you’re planning to refinance, sell your property, or simply want to stay on top of your financial planning, knowing the payoff amount can make a significant difference. In this article, we will delve into the concept of the payoff amount on a mortgage, its importance, and how to obtain it.

Understanding the Payoff Amount on a Mortgage

When we talk about the payoff amount on a mortgage, we’re referring to the total amount required to satisfy the loan in full. This includes the principal balance, any outstanding interest, and any applicable fees or penalties. Essentially, it’s the sum needed to completely pay off your mortgage.

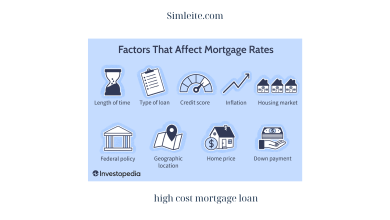

Factors that Influence the Payoff Amount

Several factors contribute to the calculation of the payoff amount. Firstly, the principal balance, which is the initial amount borrowed, plays a significant role. Additionally, the interest rate and the length of time the loan has been active affect the overall payoff amount. Furthermore, any prepayment penalties or outstanding fees may also be included in the calculation.

Calculation Methods for Determining the Payoff Amount

Lenders employ different methods to calculate the payoff amount. Some lenders use a simple interest calculation, while others may use a daily interest accrual method. It’s important to understand the specific calculation method used by your lender to obtain an accurate payoff amount.

Why Knowing the Payoff Amount Matters

Understanding the payoff amount on your mortgage offers several benefits and can greatly impact your financial planning and decision-making.

Financial Planning and Budgeting

Knowing the payoff amount helps you plan your finances more effectively. It allows you to determine how much of your monthly budget should be allocated towards mortgage payments. By having a clear understanding of the payoff amount, you can better assess your overall financial situation and make informed decisions.

Refinancing or Selling Property

If you’re considering refinancing your mortgage to obtain better terms or lower interest rates, knowing the payoff amount is essential. It enables you to evaluate the potential savings and determine if refinancing is the right choice for you. Similarly, if you’re planning to sell your property, understanding the payoff amount helps you calculate your equity and make informed decisions about your asking price.

How to Obtain the Payoff Amount

Obtaining the payoff amount on your mortgage is a straightforward process. Here’s a step-by-step guide to help you navigate through it smoothly.

Contacting the Lender

The first step is to contact your lender directly to obtain the accurate payoff amount. You can usually find the lender’s contact information on your mortgage statement or their website. Reach out to their customer service or loan department and request the payoff amount for your specific mortgage.

Necessary Information and Documents

When contacting your lender, be prepared to provide certain information and documents to verify your identity and mortgage details. This may include your loan account number, social security number, property address, and borrower information. Having these details readily available will expedite the process.

Potential Fees or Penalties

It’s important to be aware that some lenders may charge fees or penalties for obtaining the payoff amount. These fees can vary, so it’s advisable to inquire about any associated costs when contacting your lender. Being informed about potential fees allows you to budget accordingly and avoid any surprises.

Frequently Asked Questions (FAQs)

How often can the payoff amount change?

The payoff amount on a mortgage can change due to various factors. It may fluctuate if you make additional principal payments, if interest rates change, or if there are any adjustments to fees or penalties. It’s advisable to check with your lender for the most up-to-date payoff amount.

Are there any limitations on when the payoff amount can be obtained?

Generally, the payoff amount can be obtained at any time during the life of the mortgage. However, some lenders may have specific guidelines or restrictions regarding when and how often borrowers can request the payoff amount. It’s best to consult your lender directly to understand any limitations that may apply.

Can the payoff amount be negotiated or reduced?

The payoff amount is typically calculated based on the terms of the mortgage agreement and the outstanding balance. While it’s not common to negotiate or reduce the payoff amount itself, you may be able to negotiate other aspects of the mortgage, such as interest rates or fees. It’s worth discussing your options with your lender to explore any potential alternatives.

Conclusion

Understanding the payoff amount on a mortgage is essential for borrowers seeking financial stability and making informed decisions. By knowing the payoff amount, you can effectively plan your finances, evaluate refinancing opportunities, and accurately determine your property’s value when selling. Remember to contact your lender directly to obtain an accurate payoff amount, keeping in mind any associated fees. By staying informed and proactive, you can navigate your mortgage journey with confidence and financial clarity.