Short Term Mortgage Loans: A Flexible Financing Option

Short term mortgage loans provide borrowers with a flexible and convenient financing option for various needs. Whether it’s purchasing a new property, renovating an existing one, or addressing a temporary financial gap, these loans offer borrowers the ability to access funds quickly and repay them over a shorter time frame. In this article, Simleite will explore the concept of short term mortgage loans, their benefits, considerations, and how they can be utilized effectively.

Short Term Mortgage Loans: A Flexible Financing Option

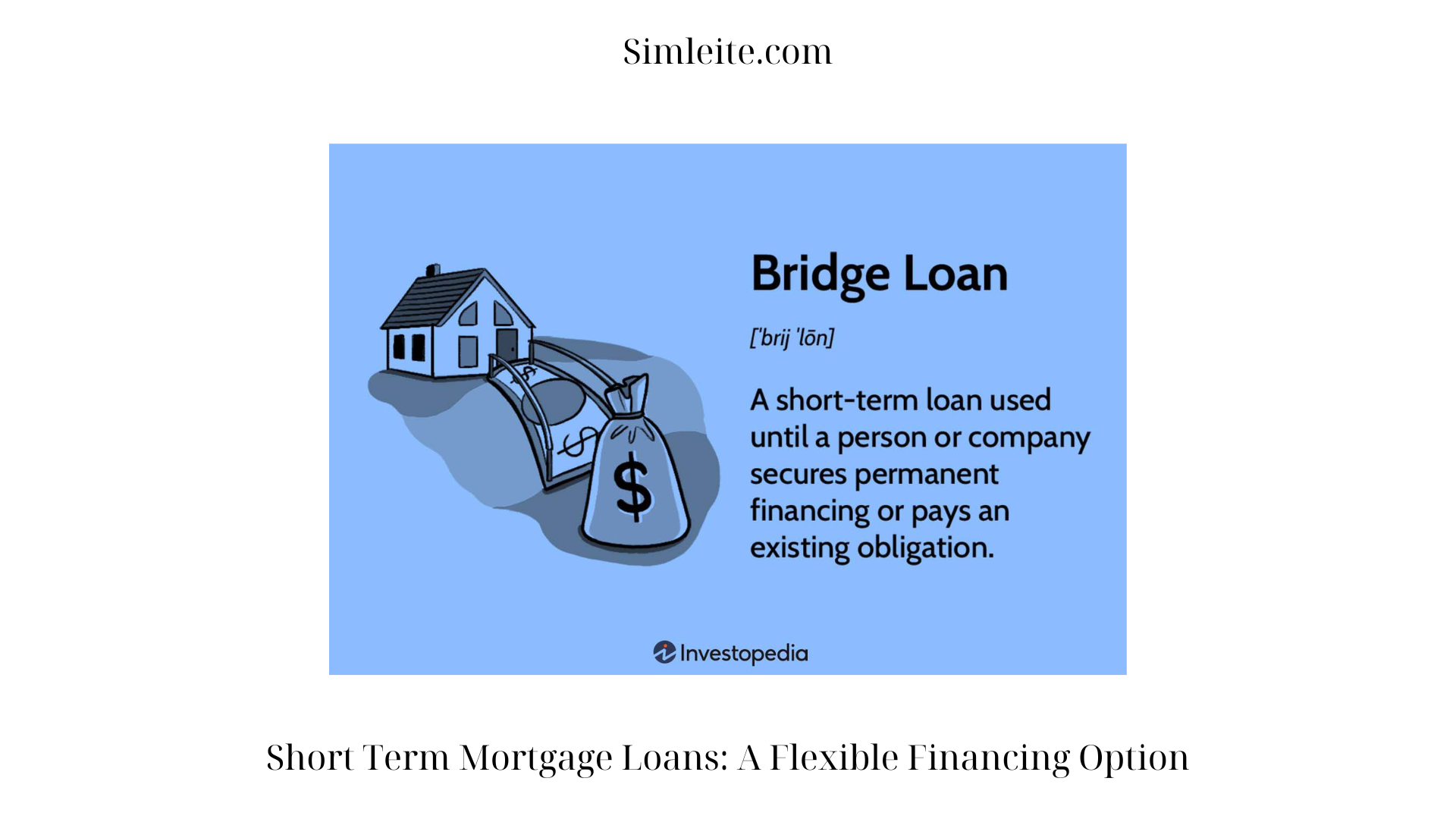

- Understanding Short Term Mortgage Loans:

Short term mortgage loans, also known as bridge loans or swing loans, are designed to provide temporary financing for borrowers until a more permanent financing solution is secured. Typically, these loans have a duration ranging from a few months to a few years, with the expectation that the borrower will repay the loan in full once a long-term financing option becomes available or a financial goal is achieved. - Benefits of Short Term Mortgage Loans:

One of the key advantages of short term mortgage loans is their flexibility. These loans offer borrowers the ability to access funds quickly, enabling them to seize time-sensitive opportunities such as a desirable property that requires immediate financing. Additionally, short term mortgage loans often have less stringent eligibility criteria compared to traditional long-term mortgages, making them accessible to a wider range of borrowers. - Bridge Financing for Property Purchases:

Short term mortgage loans are commonly used as bridge financing to facilitate property purchases. For instance, if a borrower finds their dream home before selling their current property, a short term mortgage loan can bridge the financial gap by providing the funds needed to complete the purchase. Once the borrower sells their existing property, they can repay the short term mortgage loan and secure a long-term mortgage for the newly acquired property. - Flexibility for Renovations and Improvements:

Homeowners looking to renovate or make significant improvements to their property can also benefit from short term mortgage loans. These loans provide the necessary funds to carry out the renovations, and the shorter repayment period allows borrowers to quickly complete the project and potentially increase the value of their property. Once the renovations are finished, borrowers can explore long-term financing options or choose to sell the property. - Addressing Temporary Financial Gaps:

Short term mortgage loans can be a valuable tool for individuals or businesses facing temporary financial gaps. For example, entrepreneurs who require immediate funds for a business venture or individuals in need of emergency cash flow can turn to short term mortgage loans to bridge the financial shortfall until a more permanent solution is available. This temporary financing option helps borrowers address pressing financial needs without committing to long-term financial obligations.

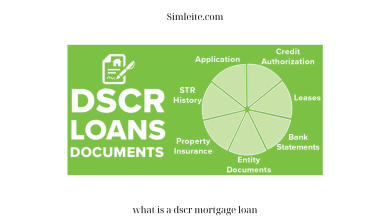

- Considerations and Risks:

While short term mortgage loans offer flexibility and convenience, borrowers must carefully consider the associated risks. The interest rates for these loans are typically higher than those of traditional long-term mortgages, reflecting the shorter duration and higher perceived risk to lenders. Borrowers should also assess their ability to repay the loan within the specified timeframe to avoid potential financial strain. It is crucial to conduct a thorough cost-benefit analysis and explore alternative financing options before opting for a short term mortgage loan. - Working with Lenders and Loan Terms:

When seeking a short term mortgage loan, borrowers should research and compare lenders to find the best fit for their needs. It is important to understand the terms and conditions of the loan, including interest rates, repayment schedules, and any associated fees. Clear communication with the lender is essential to ensure a smooth borrowing experience and to address any concerns or questions that may arise during the loan term. - Exit Strategies and Long-Term Financing:

As short term mortgage loans are temporary in nature, borrowers should have a well-defined exit strategy. This strategy may involve securing long-term financing, selling the property, or using other financial resources to repay the loan. It is crucial to plan ahead and explore long-term financing options early on to ensure a seamless transition once the short term mortgage loan term expires. - Professional Guidance and Financial Advice:

Navigating the realm of short term mortgage loans can be complex, and seeking professional guidance from mortgage brokers, financial advisors, or real estate professionals is highly recommended. These experts can provide valuable insights, help borrowers understand the intricacies of short term mortgage loans, and guide them in making informed decisions that align with their financial goals and circumstances.

Conclusion:

Short term mortgage loans offer borrowers a flexible financing option for various needs, including property purchases, renovations, and temporary financial gaps. Their quick access to funds, less stringent eligibility criteria, and shorter repayment periods make them an attractive choice for borrowers seeking temporary financial solutions. However, careful consideration of associated risks, thorough planning, and consultation with professionals are essential to ensure that short term mortgage loans are utilized effectively and align with individual financial goals. By understanding the benefits, considerations, and appropriate utilization of short term mortgage loans, borrowers can make informed decisions and leverage this flexible financing option to their advantage.