Types of Mortgage Loans in Texas: A Comprehensive Guide

When it comes to purchasing a home in Texas, understanding the various types of mortgage loans available is crucial. Whether you are a first-time homebuyer or looking to refinance your existing mortgage, having knowledge about the different loan options can help you make informed decisions that align with your financial goals. In this comprehensive guide, Simleite will explore the types of mortgage loans in texas commonly offered in Texas, providing you with valuable insights into their features, benefits, and eligibility requirements.

Types of Mortgage Loans in Texas: A Comprehensive Guide

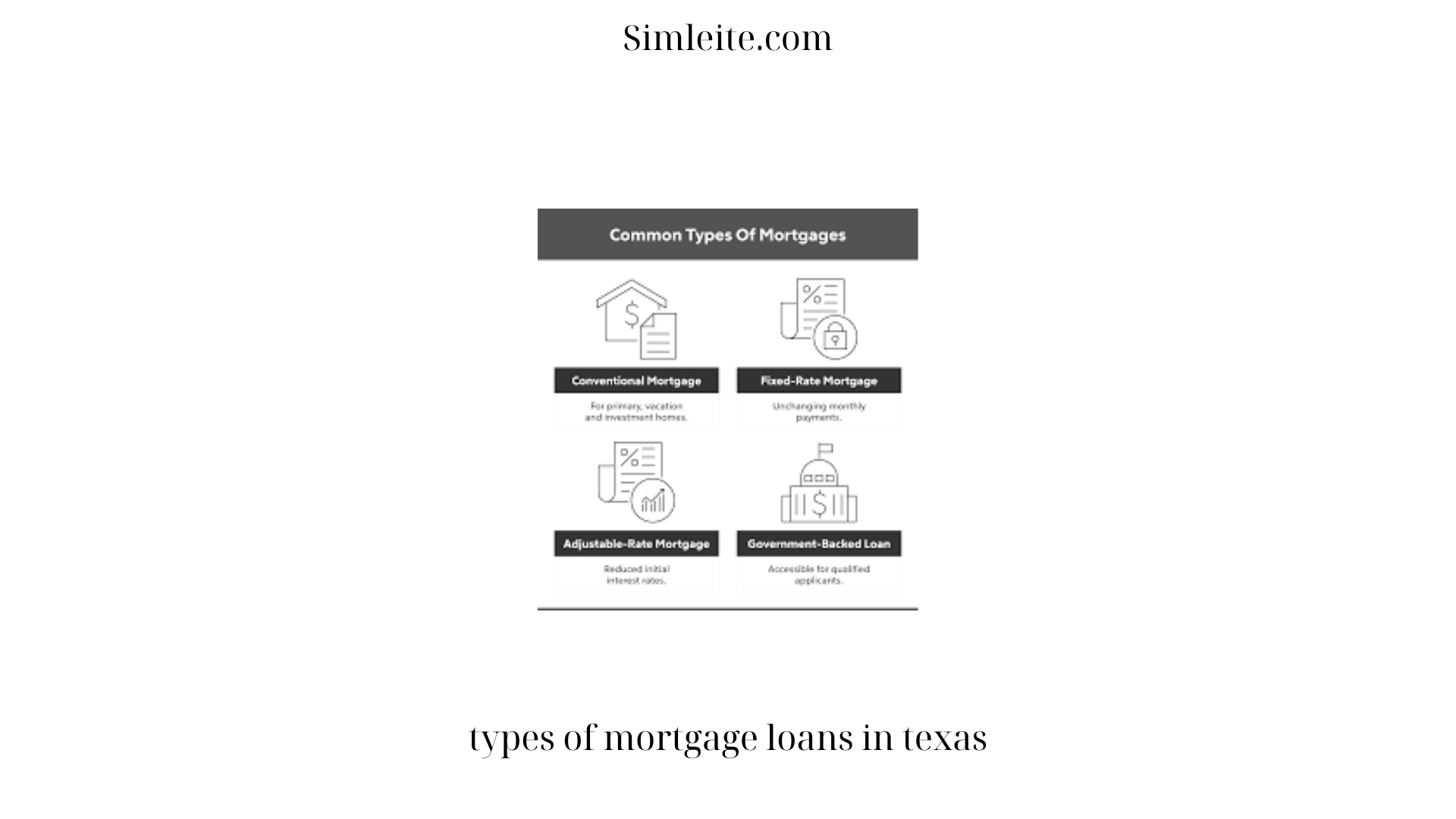

- Conventional Mortgage Loans

Conventional types of mortgage loans in texas are the most common type of home financing option in Texas. These loans are not insured or guaranteed by any government entity, which means they typically require a higher credit score and a larger down payment compared to government-backed loans. Conventional loans offer flexible terms and can be used for purchasing a primary residence, a second home, or an investment property. Borrowers with a strong credit history and stable income are often eligible for competitive interest rates and favorable loan terms.

- FHA Loans

The Federal Housing Administration (FHA) offers mortgage loans that are insured by the government. FHA loans are popular among types of mortgage loans in texas first-time homebuyers and individuals with limited down payment funds or lower credit scores. These loans have more lenient qualification requirements compared to conventional loans, making homeownership more accessible for a broader range of borrowers. FHA loans come with fixed or adjustable interest rates and allow for a lower down payment, typically around 3.5% of the purchase price.

- VA Loans

If you are a current or former member of the military, you may be eligible for a VA (Veterans Affairs) loan. VA loans are guaranteed by the Department of Veterans Affairs and offer types of mortgage loans in texas benefits such as no down payment requirement, lower interest rates, and relaxed credit score requirements. These loans are designed to help veterans, active-duty service members, and eligible surviving spouses become homeowners. VA loans can be used to purchase a primary residence and may also provide options for refinancing existing mortgages.

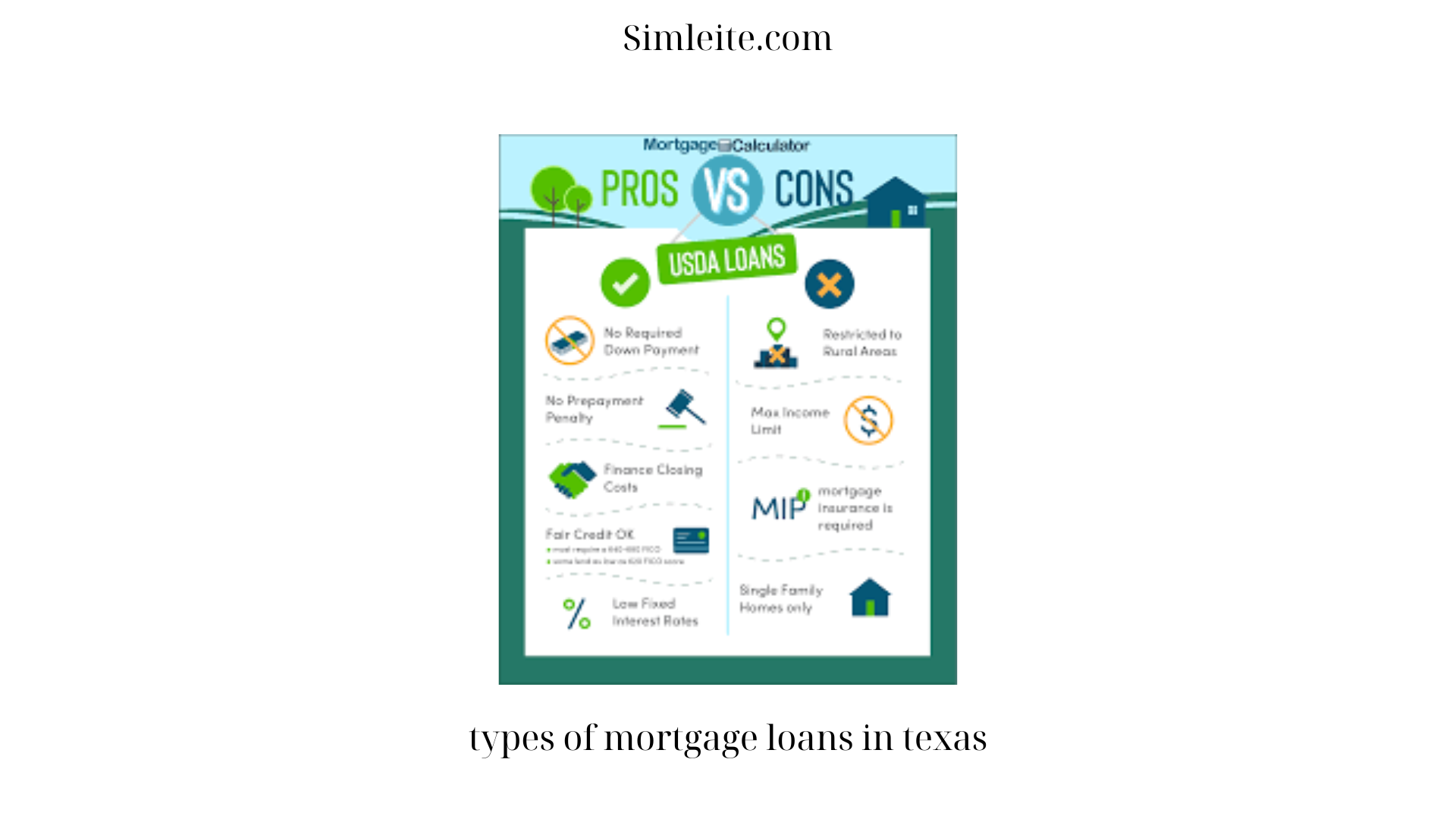

- USDA Loans

USDA (United States Department of Agriculture) loans are specifically designed to help individuals in rural and suburban areas achieve homeownership. These types of mortgage loans in texas are backed by the USDA and offer low to moderate-income borrowers the opportunity to purchase a home with zero down payment. To qualify for a USDA loan, the property must be located in an eligible rural area as defined by the USDA. Additionally, borrowers must meet income requirements, demonstrate a stable income, and have a reasonable credit history.

- Jumbo Loans

Jumbo loans, also known as non-conforming loans, are used to finance higher-priced properties that exceed the conventional loan limits set by Fannie Mae and Freddie Mac. In Texas, where home prices can be higher than the national average, jumbo loans play a significant role in the real estate market. These loans often require a larger down payment and have stricter qualification criteria compared to conventional loans. Borrowers seeking to purchase luxury homes or properties in high-cost areas may opt for jumbo loans to cover the cost of their mortgage.

- Adjustable-Rate Mortgages (ARMs)

An adjustable-rate mortgage (ARM) is a type of loan where the interest rate is fixed for an initial period and then adjusts periodically based on market conditions. In Texas, ARMs are available for both conventional and government-backed types of mortgage loans in texas. The initial fixed-rate period can vary, commonly ranging from 3 to 10 years. After the fixed-rate period ends, the interest rate adjusts annually or semi-annually based on an index. ARMs offer flexibility and may be suitable for borrowers who plan to sell or refinance their home before the adjustment period begins.

- Fixed-Rate Mortgages

A fixed-rate mortgage is a traditional types of mortgage loans in texas where the interest rate remains constant throughout the life of the loan. This means that the monthly mortgage payment remains the same, providing borrowers with stability and predictability. Fixed-rate mortgages are available for various loan terms, with 30-year and 15-year terms being the most common options. These loans are suitable for individuals who prefer a consistent payment amount and plan to stay in their home for an extended period.

- Construction Loans

If you are planning to build a new home in Texas, a construction types of mortgage loans in texas may be the right choice for you. Construction loans provide financing throughout the construction process, allowing you to pay for the land, labor, materials, and other costs associated with building your home. Once the construction is complete, the loan usually converts to a traditional mortgage. Construction loans can be customized to meet your specific needs, and the terms may vary depending on the lender and the project.

- Rehab Loans

Rehabilitation loans, also known as renovation or rehab types of mortgage loans in texas, are designed for individuals who wish to purchase a home that requires significant repairs or renovations. These loans provide financing to cover both the purchase price of the property and the cost of necessary repairs or improvements. Rehab loans can be obtained through various programs, such as the FHA 203(k) loan or Fannie Mae’s HomeStyle Renovation loan. These loans offer flexibility andopportunities for borrowers to transform a fixer-upper into their dream home.

- Reverse Mortgages

Reverse mortgages are unique types of mortgage loans in texas options available to homeowners aged 62 or older. These loans allow homeowners to convert a portion of their home equity into cash, which can be received as a lump sum, a line of credit, or monthly payments. Unlike traditional mortgages, reverse mortgages do not require monthly mortgage payments. Instead, the loan is repaid when the homeowner sells the property, moves out, or passes away. Reverse mortgages can provide financial flexibility and supplement retirement income for eligible homeowners.

In conclusion, Texas offers a wide range of types of mortgage loans in texas options to accommodate the diverse needs of homebuyers and homeowners. Whether you are looking for a conventional loan, government-backed loan, or specialized loan program, understanding the features and eligibility requirements of each type is crucial. By familiarizing yourself with the various mortgage loan options in Texas, you can make informed decisions that align with your financial goals and pave the way to homeownership or successful refinancing. Remember to consult with a types of mortgage loans in texas professional who can guide you through the process and assist you in selecting the most suitable loan option for your specific circumstances.